Watchlist Screening: What It Is and Why It Matters

Watchlist screening is the process of checking customers, entities, and transactions against official lists issued by regulators and international bodies. These lists include sanctioned individuals, politically exposed persons (PEPs), and parties linked to financial crime or terrorist financing. By flagging high-risk connections early, watchlist screening helps organizations comply with global regulations and maintain trust.

Today, regulators view watchlist screening as a baseline requirement for AML compliance. Financial institutions, fintechs, and other businesses use advanced AML software to run these checks automatically, ensuring they meet legal obligations, avoid penalties, and reduce exposure to fraud and money laundering.

What is Watchlist Screening?

The Watchlist screening process is the practice of checking customer and transaction data against predefined lists of sanctioned or high-risk individuals, entities, and jurisdictions. These lists may come from government agencies, regulators, or global organizations such as the UN or FATF. Screening ensures that businesses do not unknowingly engage with parties linked to financial crime, corruption, or terrorism, and avoid emerging risks.

In practice, the watchlist screening process can be performed manually or with automation. Manual screening, such as searching names against public databases, can work for very small organizations but is time-consuming and error-prone. Automated screening, on the other hand, uses dedicated sanctions screening software or integrated compliance platforms to process large volumes of customer data in real time. This approach reduces human error, speeds up onboarding, and makes it easier to demonstrate compliance.

A typical watchlist screening workflow looks like this:

- Collect customer information through a customer identification program (e.g., KYC processes during onboarding).

- Match this information against official watchlists or consolidated global databases.

- Review potential matches to separate false positives from true hits.

- Escalate confirmed matches for further checks, such as enhanced due diligence or AML case management.

By combining automation with risk-based review, organizations can meet regulatory requirements more effectively while reducing operational burden.

Why is Watchlist Screening Important?

The primary purpose of global watchlist screening is to protect organizations from engaging with sanctioned or high-risk parties. Regulators around the world expect financial institutions, fintechs, and even non-financial businesses to identify and block these relationships as part of their broader AML compliance programs.

Effective screening reduces exposure to:

Sanctions breaches – Doing business with entities on lists such as OFAC or EU sanctions can trigger multimillion-dollar fines, criminal liability, and severe restrictions on operations.

Terrorist financing – Screening prevents funds from being diverted to terrorist groups, a critical priority for global security.

Fraud and financial crime – By checking against lists of known offenders, businesses reduce the risk of onboarding bad actors.

Reputational damage – Beyond regulatory penalties, failing to screen can cause lasting harm to customer trust and market credibility.

As enforcement grows stricter, watchlist screening is no longer optional. It has become a minimum expectation for regulators worldwide, with ongoing monitoring required to ensure that new risks are detected as soon as they emerge.

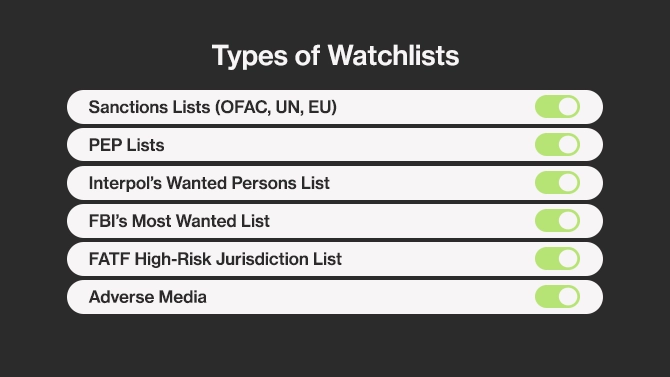

Types of Watchlists

Organizations rely on multiple types of watchlists when performing screening. Some are issued by governments or international bodies, while others are compiled from law enforcement or open sources. To simplify compliance, most businesses now use global watchlist databases that aggregate these lists, rather than manually checking each source one by one.

Global Watchlist Databases

Banks, fintechs, and regtech providers often subscribe to consolidated databases that pull information from hundreds of sources worldwide. This ensures broader coverage, reduces manual effort, and supports real-time ongoing monitoring. Using aggregated data helps businesses stay current with rapidly changing sanctions and enforcement actions

Common Watchlists

Sanctions Lists (OFAC, UN, EU): Include individuals, entities, and countries subject to economic or trade restrictions. These lists evolve as geopolitical conditions change.

PEP Lists: Track politically exposed persons who may pose higher corruption or bribery risks due to their positions of influence.

Interpol & Law Enforcement Lists: Contain individuals wanted for crimes globally (Interpol’s Red Notices) or domestically (such as the FBI’s Most Wanted).

FATF High-Risk Jurisdiction List: Identifies countries with weak anti-money laundering and counter-terrorism financing controls.

Adverse Media & Negative News Screening: Captures names tied to negative news coverage, scandals, or financial crime, even if they do not appear on formal sanctions lists.

By combining these lists within one solution, organizations gain a holistic view of customer and transaction risk, strengthening compliance and protecting against both regulatory and reputational fallout.

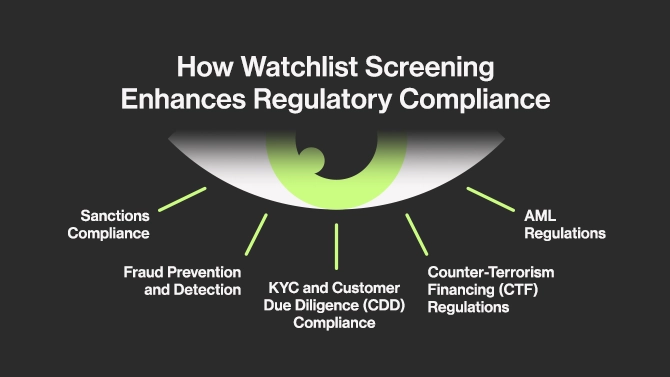

Watchlist Screening and Regulatory Compliance

Watchlist screening is at the core of global compliance frameworks. It is critical for meeting fraud prevention requirements. Regulators such as the Financial Action Task Force (FATF), the European Union (AMLD directives), and the U.S. Office of Foreign Assets Control (OFAC) all emphasize comprehensive screening as a mandatory safeguard. In many regions, failure to comply can lead not only to heavy fines but also to license restrictions or loss of market access.

Sanctions Compliance

Sanctions laws prohibit engaging with designated individuals, entities, or jurisdictions. Screening ensures that businesses block transactions with blacklisted parties and remain aligned with evolving restrictions from the UN, EU, OFAC, and other authorities.

AML Regulations

AML rules vary globally, but all require financial institutions to detect and prevent illicit money flows. In the EU, directives mandate proactive detection and reporting; in the U.S., sanctions lists are tightly enforced; and in APAC, regulators increasingly require proof of strong internal controls. Screening is the first line of defence against sanctions breaches and money laundering.

KYC and Customer Due Diligence (CDD) Compliance

Screening plays a central role during onboarding, when businesses must confirm the legitimacy of their customers. A customer identification program ensures identity data is collected correctly, while screening against watchlists validates whether a customer is restricted. Ongoing checks and CDD processes help uncover risks that may surface later in the customer relationship.

Counter-Terrorism Financing (CTF) Regulations

CTF laws aim to block terrorist organizations from accessing financial systems. Screening against global terrorism lists helps institutions detect and escalate suspicious links, ensuring they can submit a Suspicious Activity Report (SAR) when necessary.

Fraud Prevention and Detection

Modern compliance tools combine watchlist screening with fraud monitoring systems. By cross-referencing identities with sanctions, PEP, and adverse media sources, businesses can catch bad actors before onboarding is completed. Linking these checks with AML software and broader AML case management workflows ensures suspicious activity is investigated efficiently.

Data Privacy and GDPR

While screening is critical, organizations must also handle personal data responsibly. European regulators highlight that AML/CTF obligations must align with GDPR, requiring businesses to balance robust screening with strict data privacy standards.

Watchlist Screening Challenges

While essential, watchlist screening is far from straightforward. Organizations must balance regulatory demands with operational efficiency, data quality, and customer experience. The biggest challenges often include accuracy, integration, and cost.

False Negatives and False Positives

False negatives occur when legitimate matches are missed due to poor data quality or weak matching logic, exposing firms to regulatory and reputational risks. False positives, on the other hand, overwhelm compliance teams with unnecessary alerts, delaying onboarding and driving up costs. Advanced matching algorithms, risk-based scoring, and proper analyst training help reduce both issues.

Watchlist Integration

Global watchlists come in different formats and are updated at varying frequencies. Integrating them into a unified system can be complex and resource-intensive. Without proper standardization, firms risk missing critical alerts or duplicating effort across systems.

Data Quality

Incomplete or inconsistent data, such as spelling variations, missing identifiers, or non-standard naming conventions, can undermine screening accuracy. Tools with data cleansing and normalization capabilities are crucial for reliable results.

Scalability and Performance

High-volume institutions, such as banks and large fintechs, must process millions of records daily. Without scalable technology, screening becomes slow and unreliable, undermining real-time compliance needs.

High Costs

Licensing third-party databases, implementing advanced screening technology, and maintaining trained compliance staff can significantly increase operational expenses. Smaller firms often struggle to keep costs under control while still meeting global standards.

Regulatory Fragmentation

Compliance obligations differ across jurisdictions. An institution may need to follow FATF recommendations globally, EU AMLD rules regionally, and local supervisory guidance simultaneously. This patchwork of regulations makes it difficult to standardize screening approaches and increases the risk of oversight.

By addressing these challenges with strong governance and the right technology stack, organizations can turn watchlist screening from a regulatory burden into a strategic advantage.

Best Practices for Effective Watchlist Screening

To overcome challenges and meet regulatory expectations, organizations should adopt a structured, proactive approach to watchlist screening. The following best practices are widely recognized across the industry:

- Automate with AI/ML: Use intelligent screening solutions to minimize false positives, detect subtle risks, and scale efficiently.

- Regularly update watchlist databases: Ensure sanctions, PEP, and law enforcement data are refreshed in real time to capture new risks as they emerge.

- Perform risk-based screening: Apply enhanced checks for higher-risk customers, industries, or jurisdictions, while simplifying reviews for low-risk cases.

- Train staff for escalation handling: Compliance teams should be well prepared to review matches, apply enhanced due diligence, and escalate true hits into investigative workflows.

- Integrate with AML systems: Linking screening results to AML case management ensures alerts are tracked, documented, and reported properly.

Adopting these practices not only strengthens regulatory alignment but also improves operational efficiency, customer onboarding, and long-term risk management.

How to Choose the Right Watchlist Screening Software

Not all screening tools are created equal. When evaluating providers, organizations should look for solutions that balance compliance requirements with efficiency and scalability. Key features to prioritize include:

- Global list coverage: Access to consolidated sanctions, PEP, law enforcement, FATF, and adverse media databases.

- Real-time updates: Automatic syncing with the latest sanctions and regulatory changes to reduce exposure.

- Scalability: Ability to process large customer bases and high transaction volumes without delays.

- Integration with AML systems: Seamless connection to KYC, CDD, fraud detection, and reporting workflows.

- User-friendly case management: Built-in AML case management tools that make it easy to track, document, and resolve alerts.

- Regulatory alignment: Configurable settings to comply with global standards such as OFAC, EU AMLD, and FATF, as well as local supervisory guidance.

Choosing the right software ensures that watchlist screening isn’t just a compliance checkbox but a strategic component of a broader AML compliance program.

Last Thoughts

Watchlist screening is no longer optional, instead it is a baseline expectation from regulatory agencies. Businesses that fail to implement robust screening face not only heavy fines but also reputational damage and loss of customer trust.

By investing in effective sanctions screening software, integrating it into KYC processes, and aligning with global standards, organizations can stay ahead of regulatory demands while protecting their operations. More than just a compliance exercise, watchlist screening is a critical defence against financial crime, helping create a safer and more transparent global economy.